Immediately Increase Your Cash Flow with a Small or Home Based Business

| Starting a small or home based business is a great way to immediately increase your cash flow and begin building wealth. |

By starting a small or home based business, you are likely to increase your tax deductions, so you can work with your accountant and adjust your withholdings to free up more cash flow throughout the year to invest or operate your business. This is preferable to letting the government hold your money all year without paying you a dime in interest.

The government encourages business ownership and rewards entrepreneurs with increased tax credits, deductions, and shelters. And not only do you have these lucrative tax benefits through your business, you also have the opportunity to stash away more money for retirement by setting up a SEP IRA, Keogh plan, or 401(k) for your company.

When it comes to financing your business, there are quite a few options available. For smaller companies, you can partner with others, pull in sponsors, and develop trade lines of credit, which are surprisingly easy to get for those with right knowledge and properly structured businesses.

Read Entire Article Now!

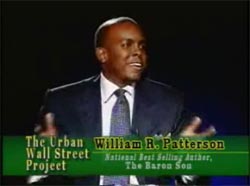

Ranked as the #1 Business Motivational Speaker by Ranking.com, William R. Patterson is a two-time award-winning lecturer, national best-selling author, and wealth coach who uses his trademark approach, THE BARON SOLUTION™, to coach, train, and motivate business leaders, sales professionals, entrepreneurs, and investors. His breakthrough book, The Baron Son, has been translated around the world and featured in the Forbes Book Club. William is an internationally recognized business authority who has been a featured guest on over 300 television and radio programs. William’s website, BaronSeries.com, is also winner of three 2008 Web Awards including Best Wealth-Building Site. THE BARON SOLUTION integrates over 200 proven business and financial accelerators to help you rapidly achieve your personal and organizational goals.

Labels: baron, building wealth, business coach, business speaker, entrepreneurship, executive coach, millionaire, small business coach, wealth coach, wealth-building, william r. patterson